Housing 31 Million Students, Will it be a Challenge?

13-01-2025

Original Published on 13-01-2025

Updated on 10-03-2025

Not all students need housing, many live with parents if they don’t have to leave their homes for higher education. But a lot of them do travel out and need affordable student housing during those formative years. Hence the words “Hostel” and “PG” entered the modern Indian lexicon.

When you hear ‘hostel,’ ‘PG,’ or the newer term ‘student housing,’ what comes to mind? Ever wondered what purpose-built student accommodation really means? Let me break it down for you!

But First, Some History!

Do you think of Raju, Farhan and Rancho from the Bollywood blockbuster 3 Idiots dancing around to “Aal Izz Well” in communal bathrooms and cramming the entire mechanical engineering syllabus in a 120 sq. ft. bunk-bed dorm room?

I grew up in Mumbai and I’ve seen many college hostels (very different from the ‘Tourist Hostels’ you may have heard of, in Europe and in Goa, closer home), though I have never lived in any. So, when I hear of “Hostel” I am instantly reminded of JS Hall at Churchgate and YMCA’s Student’s Branch over on Lamington Road, whose turn of the century neoclassical architecture, not only makes them stand out, but also lends character to the neighbourhood.

Source: University of Mumbai-JS Hall Source: YMCA-Student’s Branch

Mumbai ((formerly Bombay), one of the earliest metropolis of Asia, not just India, is a great place to start to understand the evolution of communal living, which initially started with bachelor accommodation for defense forces, then mill workers, and eventually students, coming from all over domestic and international (Mumbai university actually has an International Students Hostel- HIS at Churchgate).These shifts over time have informed student housing trends that continue to shape modern housing solutions.

During the early years of the British “Raj”, many military officers, soldiers, and lower-tier administrative staff travelled to then Bombay, for work, and as the city was enroute to becoming a leading industrial hub for British, in Asia, the rural youth saw an opportunity to earn a fortune, so they packed their bags and moved here in search of one work.

These large bunch of transient occupiers stayed in private homes and paying guest (PGs) some of which were run by families as traditional mom-and-pop shops, while others ran by religious and charitable institutes besides the “mess” and “Halls” ran by various institutes. But as their numbers grew, there weren’t enough options to accommodate them all. The city lacked sufficient accommodations and needed more.

This demand led to creation of “Chawls”, a unique architectural and overtime, cultural phenomenon of the city, which initially was meant as bachelor accommodation for mill workers and eventually became family homes. In parallel, the institutes, both religious and social ones, started creating infrastructure that could accommodate students and young people coming into the city to find opportunities. The modern “hostel” started taking shape and became one of the most influential elements to drive the cosmopolitanism of Mumbai.

Given that these facilities were mostly run by institutions and social organisations that catered to specific communities, they provided social and religion-specific food and amenities which would appeal to specific set of population, such as the Young Men’s Hostel by the Young Men’s Christian Association (YMCA), Jain Boarding Houses and the Muslim Anjuman.

This evolutionary tale stands true for any city that witnessed migration in the late 19th and early 20th century, driven by colonialism, for e.g., Chennai (formerly Madras) and Kolkata (formerly Calcutta) and many others in Asia.

During the early 20th Century more educational and industrial centres were established, migration boomed, and these cities had a surge in demand for affordable student housing. Post independence regional centres for education and industrial townships were built across the country and many forms of communal accommodation evolved, however most educational centres, like Delhi (Delhi University as well as JNU), Mumbai, IIT’s etc, built their own student housing.

This evolution paved the way for emerging college dorm investment strategies, as institutions and private investors recognized the long-term value of dedicated student housing.

Women and community-based student-specific hostels came up across, more in Kolkata and Mumbai as these were economic centers, and attracted a large student population, not just in formal education but also professional education, like chartered and cost accountancy, engineering and shipping, as these cities provided opportunities for apprenticeship and on job training.

Over time, hostels and PGs have evolved, and the new ones you see today are definitely quite different from what came earlier, even though much of it exists still today.

The Rise of Purpose-Built Student Accommodation in India

Hostels are now more synonymous with students than blue-collar workers,reflecting a shift towards purpose built student accommodation that better meets modern needs.

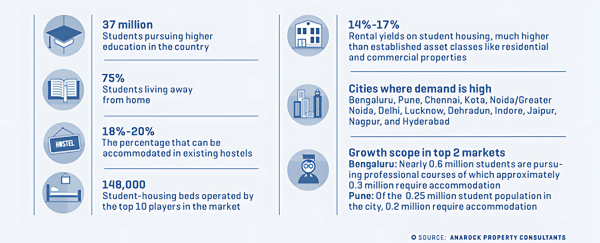

India is home to the largest youth population in the world. It is no surprise that there is a growing demand for education, which again is driven by infrastructure, both physical and social, which in turn, has driven not only the need for student accommodation but also an eye for student housing investment opportunities and raised the question, what is purpose built student accommodation in today's context.

Post-COVID (2023) ~11 million students moved out of home for higher education, however, there were only ~7.5 million beds to accommodate them on campus.[1]

Even those that managed to find accommodation on campus, realised that there were significant drawbacks because, although the fees were subsidised, hostels lacked quality amenities that many consider basic today.

Property consultant JLL’s research on the student housing market in India found that current students wanted premium and top-notch shared spaces that offered amenities and were willing to pay for it.

This insight has accelerated the development of solutions like purpose built student accommodation India. In fact, similar trends can be observed globally in hubs such as purpose built student accommodation Dublin, purpose built student accommodation Australia, highlighting that high-quality living spaces are a universal need.

Purpose-Built Student Accommodations (PBSAs) are emerging as a great solution to bridge the gap and meet the growing demand, while providing economic returns.

What is Purpose Built Student Accommodation:

PBSAs are housing facilities that are designed for students which provide tailored amenities and services to meet the needs of today’s youth.

These are particularly valuable in places such as Kota, where on-campus accommodation options are scarce, as there are no institutions per se, but coaching centers for entrance exam preparations. As the “coaching capital of India” that houses aspirants preparing for various competitive entrance examinations—many of whom are under 18 years and away from home, lack of quality accommodation while preparing for some of the most challenging competitive exams, adds additional stress.

PBSAs such as Orooms[2] make this process easier by providing well-equipped and student-friendly housing in India, exemplifying purpose built student accommodation in action.

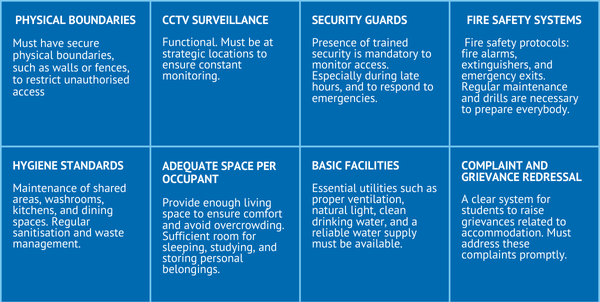

Regulatory bodies also recognise the importance of quality student accommodations and guidelines have been specified by the University Grants Commission (UGC) and the Ministry of Human Resource Development[3] on student housing.

Key players in the PBSA space operate across the country with various differentiators. For example, Good Host Spaces, PE funded Student Accommodation operator, provides on-campus accommodation for students at OP Jindal University, Sonipat and Manipal University, Jaipur, among others.

And given the size and potential of this space, the Student Housing segment, including PBSA’s as a service operators; have been attracting significant investments. Recently Alta Capital purchased ~75% of Goldman Sachs’ stake in Good Host Spaces; valued at ~Rs. 2771 crores.[4]

Similarly, Alpha Wave Global, Alteria Capital and many other funds have invested in another PBSA operator, Stanza Living, with last raise in May 2024, bringing in ~Rs. 110 crores.

The entire business model was upended during the Pandemic, and those who survived have not just learnt how to deal with such disruptions in the future but have also come out stronger due to the massive growth in student numbers over the last 2-3 years.

As on campus student accommodation continues to be constrained due to land and other infrastructural hindrances, at established educations centres, PBSA’s provide a significant opportunity, as there is a need to create space for the ~31 million students who are projected to move out of their home and hometowns by 2036, i.e. a 4.8x growth in supply.[5]; providing an expected CAGR for PBSA market at 7.2% from 2024 to 2029.

Another off shoot of the “hostel”, is the modern communal, pioneered and catered to by “Co-living” properties. These too are purpose built, but are not specific to students, as they also cater to young working professionals. With the growing cost of housing, smaller and affordable accommodations are not available closer to workplaces. Co living is the modern avatar of workers/ bachelor accommodation, fit for today’s digital work force, complementing trends seen in purpose built student accommodation.

PBSA: Driving Social Innovation and Economic Opportunity in Modern Student Accommodation

Incidents of theft, harassment, and even violence have been reported in hostels and PGs and remains a major concern for both students and their parents.

According to a study on pre-matric hostels[6] by the National Crime Records Bureau (NCRB)[7], only 10% were found to have functional CCTV cameras installed and only 15% had adequate fire extinguishers.

PBSAs prioritise safe environments, providing quality security systems, like access-controlled premises, fire safety, 24/7 surveillance and quality physical security for the premises. Some PBSA’s also bundle services like pick-up and drop to colleges, as part of their stay packages. These spaces generally aim to be in close proximity of colleges and universities, which reassures users, not just about high quality safe indoor spaces, but also reduced effort in transit, with safe commute options.

Better infrastructure and safety of student accommodation is actually corelated with increased enrolment, especially for women. In the 5-year period (2015-2020) the female student enrolment rate increased by 18.7%. When correlated with what the UGC Chairperson, M Jagadesh Kumar said, about girl’s hostels being one of the factors, among others, which “played a crucial role” in the access to higher education for females.[8], PBSA’s make strong case for investments.

Types of Purpose Built Student Accommodations and Their Use Cases:

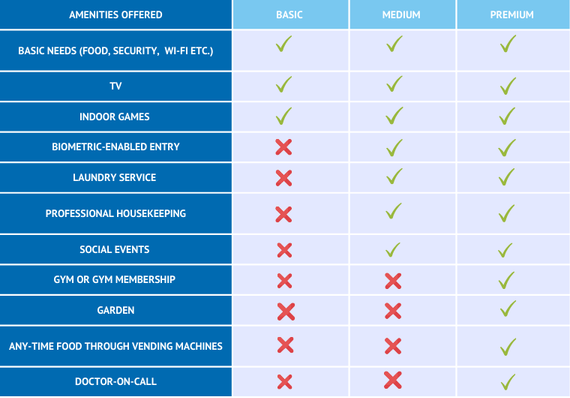

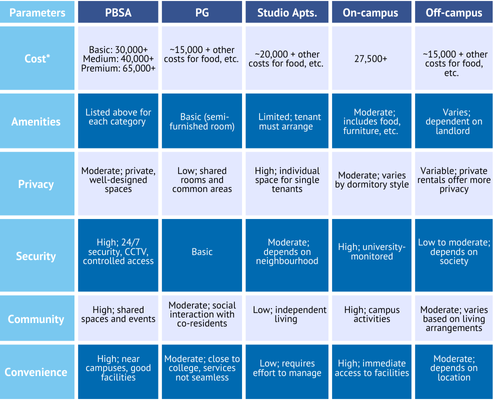

PBSAs can be simplistically classified into three levels—Basic, Medium, and Premium. Unlike traditional on campus hostels, which were made to “fit all”, modern PBSA’s provide students and their families choices, a key aspect of modern student housing design that suit their budget and preferences.

There are PBSA’s that are mirroring the traditional community or gender or even culinary specific (Veg-only) hostels as well, catering to niche markets, which are willing to pay for such differentiations.

This approach naturally answers the question “what is purpose built student accommodation” for specialized groups, ensuring that those with distinct needs can access quality living spaces without compromise.

Another reason why PBSAs have seen significant adoption is because of the rising rents of apartments in Tier-1 cities and the unavailability of quality, self-use, rentable accommodation for students in most cities. This trend has encouraged student housing investment opportunities while also fuelling interest in options like purpose built student accommodation in India for urban student populations.

The high cost and difficulty of finding apartments or homes, to rent, that allows bachelor’s to live, mostly with “flat mates” is leaving hardly any options for “off campus” self-rented/ self-managed student housing.

Those who still look to rent an apartment have to go through the hassle of paying for hefty rent deposits added with high costs of managing utilities, buying/renting furniture (in case of unfurnished or semi-furnished units), housekeeping, food (if you don’t want to eat from restaurants all the time), and general maintenance.

Reassessing Traditional Student Housing: Why Old Models No Longer Make Economic Sense

- Paying Guest (PG) facilities: Rooms/beds in a room with meals and basic utilities provided by a family, or an individual operator.

- Off Campus self-managed accommodations: Compact, single-room units with a kitchenette and bathroom, likes of which are dwindling.

- Live in On-Campus Housing: Institution-provided accommodation with amenities shared with other students at the same college or university; where new stock is not being created, due to costs and infrastructure hurdles.

- Live in Off-Campus managed Housing: Independent accommodation near campus that would be shared with other flat mates, still quite common in US and Europe, and some educational hubs, like Manipal, Kota etc, but quality and safety concerns remain, especially for women.

*Cost per month for student accommodation options in a ~1km radius for NMIMS deemed-to-be-University, Mumbai Campus. This data is as per information sourced online and through personal interviews (December 2024) and for double occupancy/twin-sharing room.

Let’s Talk Business

PBSA is almost similar to an operating hotel, but instead of over-night/ short stay guests, you have students who stay for months or years.

Similar to how a hotel charges guests per night, a PBSA charges students a fixed rent per bed per month, per semester or per year. This is their primary source of income, which ensures a steady flow and mostly, upfront revenue, as students usually live for extended periods of time.

Topline can be calculated as = No. of Beds × Occupancy Rate × Monthly Rent

For e.g., for 300 bed facility, average 90% occupancy rate, and a ₹30,000 monthly rent per student, the monthly revenue would be INR 81 lakhs and annually INR 9.72 crores.

This model highlights why many question whether student housing is a good investment and further fuels opportunities in the sector

Like Hotels, which provides specific services, PBSAs provide student specific meal plans, laundry services and standard housekeeping. These services are typically bundled into rental packages, adding an average of 20–30% to the base rent or priced à la carte, thereby enhancing the overall value proposition of student housing property investment.

For certain services, purpose built student accommodation in India may also use tie-ups. For e.g. Skyland Life in Vile Parle, Mumbai has collaborated with a local gym to provide students with an annual membership which is included in their rent of ~INR 9 lakhs per year.[9]

PBSA providers can further optimize underutilized spaces by leasing them to businesses such as cafes, vending machines, photocopier shops, libraries or even co-working spaces. They can also partner with local businesses such as nearby dry-cleaners, gym, stationeries etc.; converting costs for students into additional revenue streams through partnerships, alliances or downstream integrations. Fixed fees or revenue share from these outsourced operations are generally the practice.

This holistic approach not only streamlines services but also reinforces the model as a solid student housing investment strategy.

Investor Interest in PBSA and Student Housing: Uncovering the Power of Purpose Built Student Accommodation Investment Opportunities

The long-term nature of PBSA leases—typically aligned with academic years—offers a kind of stability which is hard to find in other real estate assets. Consequently, these purpose built student accommodation facilities generate predictable, consistent cash flows, making them attractive to investors seeking stable income-generating assets.

Additionally, student housing investment in PBSAs requires less effort to ensure year-round occupancy compared to traditional hospitality assets like hotels.

With rental yields of approximately 14–17%, these returns far exceed those of standard residential and commercial properties.

Source: JLL

Business Models for PBSAs[10] in India

Management Only:

- The (mostly branded) PBSA operator is responsible for managing the property but doesn’t own it, eg. the university accommodations managed by Good Host

- Revenue is derived from management fees and additional services.

- Costs are for operations and a fee/ profit share with the University/ Land lord.

Lease-Operate-Transfer (LOT):

- Lease to operate model

- Minimal upfront capital investment compared to building new properties.

- The focus is on operational efficiency and maximising rental income during the lease term.

- High upfront cost for lease deposits, unless lease is structured as minimal fixed and more revenue share

- Costs for converting existing house/ apartments into PBSA stock

- At the end of the lease, the property reverts to the original owner.

Stats from around the world

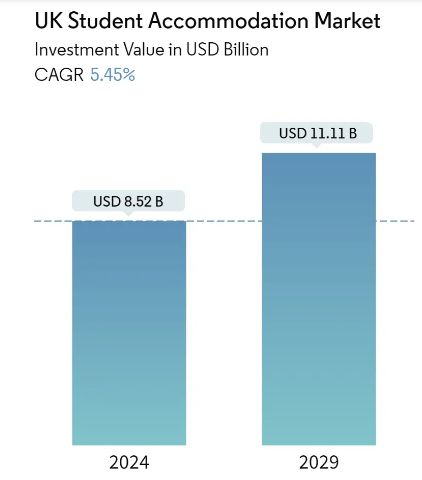

United Kingdom

The UK student accommodation market is mature and well-established.

Source: Mordor Intelligence[11]

In early 2000s the market was exposed to large-scale student accommodations and since then, UK’s PBSAs have set a foundation that have become a global standard.

The influx of demand for student accommodation in places with high concentrations of universities, such as London and Manchester have led to an expectation of a ~5.5% CAGR growth in number and value of transactions.

Some of the key players in the market are CRM Students (23,000+ beds)[12] , Unite Group (68,000+ beds)[13], Uni Acco (1.5 million+ beds)[14] and University Living.[15] (2 million+ beds).

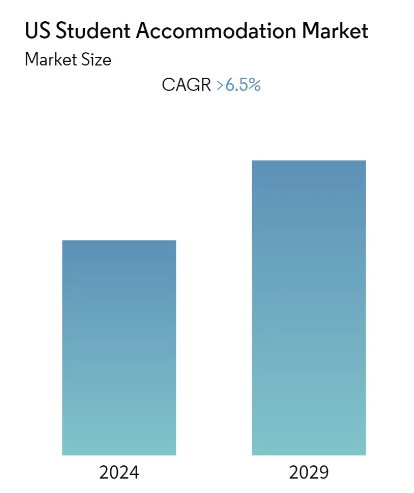

United States of America

While international students contribute towards the demand for student accommodation in the UK, in the US, the occupancy is filled majorly by internally migrated students.

The institutional student housing market in the U.S. has consistently received investments due to stable enrolment levels at four-year public universities. In fact, American Campus Communities (ACC) is a Real Estate Investment Trust (REIT) that includes only student accommodations in their portfolio. In 2o22, Blackstone Real Estate Income Trust, Inc. (BREIT) and Blackstone Property Partners (BPP) finalised their previously disclosed acquisition of all outstanding common stock of American Campus Communities, Inc. (ACC)[16]

Source: Mordor Intelligence[17]

Germany

While the student housing market in Germany is less developed compared to the U.S., there are REITs and companies that still focus on multi-family accommodations (eg. Grand City Properties)[18].

Over the last few years, Germany has become a popular student destination, due to the free-tuition initiative at public universities for domestic and international students (reached record-high of 307,900 in the 2023/24 academic year).[19]

Inflation in major German cities including Berlin and Munich has significantly impacted the housing market, leading many individuals to abandon the idea of building their own homes.

The rising costs associated with home construction and property acquisition have made homeownership unattainable for many. This shift has intensified pressure on the overall rental property market, resulting in price hikes that have also affected student housing.[20] In Berlin, the rental market has experienced rents increasing by 11.4% in 2024 compared to the previous year.[21]

Emerging Global Markets

Australia, Dubai and Singapore and Purpose Built Student Accommodation in Dublinare receiving good recovery post-pandemic as international student enrolment has increased, resulting in a surge in demand for student housing. Purpose Built Student Accommodation in Australia has recorded a 16% increase in enrolments since 2019[22] and Singapore welcomed ~65,400 students at the end of April 2o22 which was a 10% increase from the previous year.[23]

Dubai is a leading educational hub in UAE according to CBRE[24], which is driven by a growing presence of international education providers and ongoing government initiatives. Dubai’s student housing market is poised to offer significant opportunities for student housing investment.

What is AFINUE Doing?

While it may seem that there are limited options for non-institutional / HNI investors to enter the PBSA space, with operators and developers traditionally setting up and managing these properties, AFINUE is looking at changing this, by working on introducing the following structures that require smaller amounts of capital, making student housing investment more accessible.

- Operations Backed Opportunity: Ringfenced SPVs will lease the property, and invest for leasehold improvements and movable assets, in a Franchise Owned; Company Operated (FO;CO) model. Ideal for locations with high rental potentials, but limited property value appreciation (existing hubs).Structured for 16% - 20% Post Tax XIRR. It reflects the principles behind purpose built student accommodation and answers the question what is purpose built student accommodation in today's market.

- Movable Asset Backed Opportunity: Ringfenced SPVs will purchase movable assets (such as furniture, air conditioning units etc.) and lease it to a PBSA Operator. Structured for 13% - 15% Post Tax XIRR. This approach creates a compelling student housing investment opportunity and answers the question that is student housing a good investment by saying that when approached with innovative financing models, it is.

Our members will be able to participate in these transactions, by contributing to these ringfenced SPVs and receive periodic payouts. This model provides an accessible entry point for investors asking should I invest in student housing or wondering is buying student housing a good investment. With a ready pipeline, investors can benefit from student housing property investment across key markets. We are gearing up to launch soon.

Bibliography:

[1] Ascendix Technologies. (n.d.). What is PropTech in real estate: Definition, examples, and market overview. Retrieved from https://ascendixtech.com/proptech-real-estate-definition/

[2] Corporate Finance Institute. (n.d.). Maslow's hierarchy of needs. Retrieved from https://corporatefinanceinstitute.com/resources/management/maslows-hierarchy-of-needs/

[3] Economic Times. (2023). PropTech startup Crib to invest $1 million in digitizing student housing and co-living market. Retrieved from https://economictimes.indiatimes.com/industry/services/property-/-cstruction/proptech-startup-crib-to-invest-1-million-in-digitising-student-housing-and-co-living-market/articleshow/107813484.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

[4] Economic Times. (2024). What’s driving the demand in India’s nascent student housing market? Retrieved from https://economictimes.indiatimes.com/industry/services/property-/-cstruction/whats-driving-the-demand-in-indias-nascent-student-housing-market/articleshow/105215302.cms

[5] Embassy Group. (2019). Embassy Group forays into co-living space; to invest Rs 2,000 crore in first phase. Retrieved from https://www.moneycontrol.com/news/business/real-estate/embassy-group-forays-into-co-living-space-to-invest-rs-2000-cr-in-first-phase-4840291.html

[6] Entrackr. (2024). Exclusive: Stanza Living raises $13 million led by Alpha Wave. Retrieved from https://entrackr.com/2024/05/exclusive-stanza-living-raises-13-mn-led-by-alpha-wave/

[7] Financial Express. (2023). Co-living 3.0: Redefining community living for millennials and Gen Z. Retrieved from https://www.financialexpress.com/money/co-living-3-0-redefining-community-living-for-millennials-and-gen-z-3573442/

[8] Fortune India. (2022). Home away from home. Retrieved from https://www.fortuneindia.com/venture/home-away-from-home/104009

[9] Good Host Spaces. (n.d.). Home. Retrieved from https://www.goodhostspaces.com/home-2/

[10] Grand City Properties. (n.d.). About us. Grand City Properties. https://www.grandcityproperties.com/about-us

[11] GSL Global. (2024, November 23). Germany welcomes record number of international students as student housing crisis worsens. Retrieved from https://gslglobal.com/2024/11/23/germany-welcomes-record-number-of-international-students-as-student-housing-crisis-worsens/

[12] Hindustan Times. (2023). Women comprise 48% of overall enrollment in higher education: AISHE report. Retrieved from https://www.hindustantimes.com/education/news/women-comprises-48-of-overall-enrollment-in-higher-education-aishe-report-101706323112640.html

[13] iPleaders. (2019). Legal requirements for setting up PGs and hostels in India. Retrieved from https://blog.ipleaders.in/legal-requirements-setting-pgs-hostels-bbs/

[14] JLL. (2017). Student housing: A new dawn in Indian real estate. Retrieved from https://www.jll.co.in/content/dam/jll-com/documents/pdf/research/apac/ap/in_student_housing_jul_17.pdf

[15] JLL. (n.d.). Housing market overview. Available at https://www.jll.de/en/trends-and-insights/research/housing-market-overview

[16] Maharashtra Housing and Building Laws. (n.d.). BMC Chapter 18 Manual 17. Retrieved from https://maharashtrahousingandbuildinglaws.com/b-m-c-chapter-18-manual-17/

[17] MagicBricks. (n.d.). Indian student housing giant Good Host Spaces sold for Rs 2,700 crore. Retrieved from https://www.magicbricks.com/news/indian-student-housing-giant-good-host-spaces-sold-for-rs-2700-crore/133255.html

[18] Ministry of Education, Government of India. (2020). National Education Policy 2020. Retrieved from https://www.education.gov.in/sites/upload_files/mhrd/files/NEP_Final_English_0.pdf

[19] Ministry of Education, Government of India. (2023). All India Survey on Higher Education 2020–21. Retrieved from https://aishe.nic.in/aishe/viewDocument.action?documentId=353

[20] Moneycontrol. (2023). Race for Goldman Sachs-backed Good Host Spaces: Alta Capital in lead to acquire India’s largest student housing platform. Retrieved from https://www.moneycontrol.com/news/business/companies/race-for-goldman-sachs-backed-good-host-spaces-alta-capital-in-lead-to-acquire-indias-largest-student-housing-platform-11521451.html

[21] Mordor Intelligence. (n.d.). Student accommodation market - Growth, trends, COVID-19 impact, and forecasts (2023 - 2028). Retrieved from https://www.mordorintelligence.com/industry-reports/student-accommodation-market

[22] Mordor Intelligence. (n.d.). U.S. student accommodation market - Growth, trends, COVID-19 impact, and forecasts (2023 - 2028). Retrieved from https://www.mordorintelligence.com/industry-reports/us-student-accommodation-market

[23] National Commission for Protection of Child Rights (NCPCR). (n.d.). Study on safety and security of children in pre-matric hostels. Retrieved from https://ncpcr.gov.in/uploads/165650386562bc3e39a9956_study-on-safety-security-of-children-in-pre-matric-hostels.pdf

[24] Orooms. (n.d.). Homepage. Available at https://www.orooms.in/

[25] Propacity. (n.d.). Student housing in India: Opportunities, challenges, and the road ahead. Retrieved from https://propacity.com/blogs/student-housing-in-india/

[26] REIT Notes. (2023, December 12). ACC, Blackstone funds complete $13 billion acquisition of American Campus Communities. REIT Notes. https://www.reitnotes.com/reit-press-releases/ACC-Blackstone-Funds-Complete-13-Billion-Acquisition-of-American-Campus-Communities

[27] RP Realty Plus. (n.d.). Germany's student housing gets more expensive. Retrieved from https://www.rprealtyplus.com/international/germanys-student-housing-gets-more-expensive-116921.html

[28] Skyland. (n.d.). Skyland One. Retrieved from https://www.skylandlife.in/skyland-one.html#7

[29] Skyland Heights. (n.d.). Skyland Heights. Retrieved from https://www.skylandlife.in/skyland-heights.html#2

[30] Stanza Living. (n.d.). About us. Retrieved from https://www.stanzaliving.com/about-us

[31] Student housing in the UAE: An untapped market for investment. Available at https://www.cbre.com/insights/articles/student-housing-in-the-uae-an-untapped-market-for-investment

[32] The Business Times. (2023, November 20). Foreign enrolment in Singapore private schools picks up as borders reopen. Available at https://www.businesstimes.com.sg/singapore/economy-policy/foreign-enrolment-singapore-private-schools-picks-borders-reopen

[33] University Grants Commission (UGC). (2014). Safety of students on and off campuses of higher educational institutions: Guidelines. Retrieved from https://www.ugc.gov.in/pdfnews/4006064_Safety-of-Students-Guidelines.pdf

[34] UniAcco. (n.d.). Homepage. Available at https://uniacco.com/

[35] University Living. (n.d.). Homepage. Available at https://www.universityliving.com/

[36] Unite Group. (n.d.). Homepage. Available at https://www.unitegroup.com/

[37] ZoloStays. (n.d.). Which cities does Zolo operate in? Retrieved from https://zolostays.com/faqs/about-zolo/which-cities-does-zolo-operate-in

Related Blogs

10-01-2023

Can you invest in wine - What you need to know

Wine has been an investment asset class for as long as humanity has known to produce it. Unlike Whiskey, where you let it mature for equity gains, wine’s value grows even when stored in bottles, as the vintage and provenance matter in pricing

10-01-2023

Why is Whisky a Good Investment?

Whiskey is an untapped niche for serious investors and, in a period when redundant capital has chased up the prices of nearly everything else, it is worth a look, on those grounds alone.

12-07-2023

Being serious about ‘Horse’-ing around

Horse ownership is not limited to only the ultra-wealthy. Read more on fractional ownership avenues to participate in this equestrian world.

13-01-2025

Housing 31 Million Students, Will it be a Challenge?

Step into India's evolving world of purpose built student accommodation, where affordable student housing, modern campus living, and innovative investment opportunities redefine smart choices.

29-06-2023

550% returns in 13 years on a physical asset

Since 2010, gold has given a 200% return and silver 167%. Most people would be happy with those numbers. But imagine making over a 550% return on your investment, while being able to wear and flaunt it!