Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Picture this: You own an apartment that not only appreciates in value but also generates consistent rental income without the hassle of finding tenants, managing maintenance, or dealing with vacancy periods. Welcome to the world of hotel apartments – where real estate meets hospitality, and investors meet extraordinary returns.

In the heart of the Middle East's most dynamic city, a revolution in property investment has been quietly unfolding over the last 2 decades.. While traditional real estate investors grapple with market volatility and tenant management challenges, a growing number of savvy investors have discovered the golden opportunity that lies within Dubai's hotel apartment sector, buoyed by tourism.

The Genesis: When Dubai Opened Its Hospitality Doors to Investors

The concept of selling hotel apartments to private investors isn't entirely new, but Dubai has elevated it to an art form. The emirate's vision began taking shape in the early 2000s, when the government recognized that tourism would be a cornerstone of its economic diversification strategy.

The theory behind selling hotel units to individual investors was revolutionary yet simple: democratize hospitality investment. Instead of requiring investors to spend millions to develop an entire hotel, Dubai introduced a model that allowed developers to forward sell the units and finance the development, and for the investors to purchase individual units within branded hotel properties. The regulatory support and visionary leadership of the country led to a market where;

- Hotels could raise development capital more efficiently and expeditiously without relying on local debt

- Individual investors could enter the hospitality real estate market with lower capital requirements.

- Professional hotel operators would get a large portfolio of properties within a short time, ensuring consistent service standards while managing costs efficiently, and

- Rental guarantees for investors/ buyers of the hotel units and apartments, while high, were still significantly lower than foreign debt with hedging costs, in a seemingly volatile market like Dubai.

Pre-COVID: The Foundation Years (2015-2019)

Before the pandemic reshaped global travel, Dubai's hotel apartment market was steadily establishing itself as a viable investment alternative. The period from 2015 to 2019 was characterized by[3] :

Market Growth

- Hotel room inventory reached approximately 120,000 rooms by 2019[3]

- Average occupancy rates hovered around 76-78%[3]

- Tourist arrivals peaked at 16.73 million in 2019[4]

Investment Characteristics

- Average rental yields: 5-8% annually[3]

- Property appreciation: 3-5% per year

- Investment tickets: Starting from AED 1.5 million for studio apartments/hotel units

Popular Locations

The pre-COVID era saw concentration in key areas:

Post-COVID Phoenix: The Remarkable Recovery Story

If there was ever a testament to Dubai's resilience and vision, it was the hospitality sector's post-COVID recovery. While cities worldwide struggled with travel restrictions and economic uncertainty, Dubai charted a different course. By the end of 2021, some Dubai hotels were already reaching almost full occupancy, signifying the sector's return to normal and Dubai’s demand as a tourist destination.[2]

Notwithstanding the slowdown during the COVID years, the UAE now hosts one of the richest hospitality markets in the world, with an expected 25% growth in the industry by 2030 and 40 million new visitors staying at hotels in Dubai by 2031.[3]

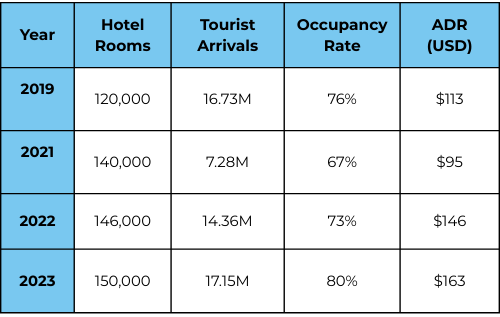

The Recovery Statistics

Dubai's hospitality sector hit $29.4bn in 2022 amid Covid rebound, and the numbers tell a remarkable story.[4]

2022 Performance Indicators[4]:

- Occupancy Rates: Reached 73% (one of the world's highest), up from 67% in 2021

- Room Nights: 37.43 million – up 19% year-over-year and 17% above 2019 levels

- Average Daily Rate (ADR): US$146, representing a 29% increase from 2019

- Revenue per Available Room (RevPAR): US$106, up 25% from pre-pandemic levels

2023 Breakthrough[4]:

- In 2023, the city welcomed 17.15 million overnight visitors, surpassing its previous high of 16.73 million in 2019

- Early 2023 occupancy rates averaged 80%

- ADR climbed to US $163

- RevPAR reached US $130, 16% above 2019 levels

How Hotel Apartment Investment Works: The Dubai Model

The Dubai hotel apartment investment model operates on a sophisticated yet investor-friendly framework.

Ownership Structure

When you purchase a hotel apartment in Dubai, you own the title deed to the property, just like any other freehold real estate investment. However, the property operates within a hotel environment, managed by the developer's own hospitality arm (e. ROVE is by Emaar, while Paramount Hotel is run by Damac Properties) or professional hospitality companies (eg, SLS Hotel is run by the Accor Group).

Rental Guarantees

While the payout to investor/ unit owners vary in terms of timing and value, there are basically two broad categories.

- Fixed Rental - this is a simpler but lesser used model, where the developer sells, and then leases back the hotel units, for a fixed rental, generally paid quarterly or annually; OR

- Revenue Share- where the gross earnings of the hotel are reduced by operating expenses, and the balance is shared with the unit holders basis the unit type, carpet areas, and revenue per unit type, through a pre-agreed formula which is then audited by an auditor, post which payouts are made to the owners, mostly once a year.

- There are sun set clauses in most deals, where the rental guarantee could be for a tenure of 5 or 10 years, and thereafter the payouts are only linked to revenue share.

Usage and User Rights

Most Hotel Unit investments come with few additional perks for the investors, like free nights, with or without blackout dates. Generally ranges between 14- 21 days a year, where the investors have free nights to use in their own units or similar units in the hotel. Additional benefits of discounted rates for stay/ services, owner rates across hotels owned/ operated by the same owner/ operator etc, can also form part of the investment. It's therefore very important to understand the investment ROI in detail, and is not standard for all hotel units being offered, in primary or in secondary sale.

The unit holder does not generally get a say in operations or the right to choose/ replace operators. As such, the developer controls the property's future outcomes, even after selling out the property to retail investors.

Hotel units and apartments can be sold in the open market, however, all owners have to accept the terms of usage as determined by the developer/ operator, as the units are not freely controlled by the investor-owner.

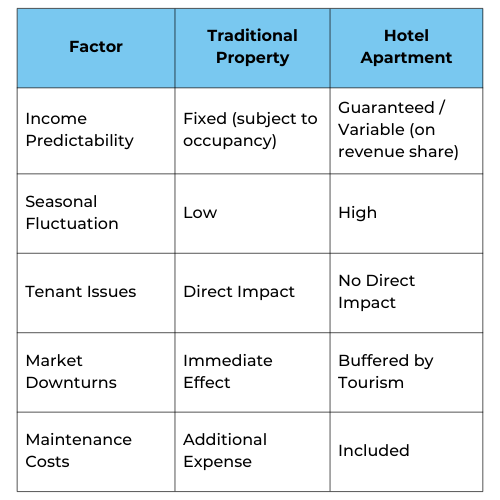

Hotel Apartments vs. Traditional Properties: The Investment Advantage

The question every investor asks: "Why choose hotel apartments over traditional residential properties?" The answer lies in the fundamental differences in investment dynamics:

Rental Yield Comparison

Traditional Dubai Residential Properties:

- Rental Yields: 3-6% annually[1]

- Tenant Management: Required to be done by owner or at additional cost

- Maintenance: Owner's responsibility

- Vacancy Risk: High during market downturns

- Property Management: Owner handles or pays separately

Dubai Hotel Apartments[2]:

- Rental Yields: 6-15% annually (from revenue share)

- Tenant Management: Hotel operator handles

- Maintenance: Included in management fee

- Vacancy Risk: Distributed across hotel operations

- Property Management: Professional hospitality management

Income Stability Matrix

Consistent High-Yield Returns with Passive Ownership in Hotels

Investing in Dubai hotel units typically delivers superior, more predictable returns. Many developments guarantee roughly 8–10% annual ROI due to strong tourist demand.[2] Hotels in prime districts typically enjoy high occupancy and steady bookings. Newer locations, like those that are close to high traffic tourist destinations (eg. Yas Islands in Abu Dhabi, or developing Al Marjan island in Ras Al Khaima) are being built with a promise of localised high density tourist demand, in an attempt to replicate the Dubai model, with adjacency to Dubai. Crucially, operators handle all bookings and maintenance, so owners truly benefit from a fully hands-off model, with a guaranteed high quality asset management.[2]

Residential Apartments: Moderate Yields but higher Capital Appreciation and Liquidity

New Dubai apartment projects have shown only modest growth in yield, since Covid-19 but very high capital appreciation. Older projects in high demand areas like Downtown or Jumeirah Beach and even Dubai Marina, have shown significant capital appreciation, as well as re-rating of rental yields, which is not likely to repeat again in the near future.[1]

Older projects like Azizi Riviera studios roughly doubled in price (~99.9% total, ~9.1% YoY) over 7–8 years, and off‑plan purchases in new projects like Binghatti Skyrise saw ~70% appreciation since its launch.[1]

Some residential projects however have shown a varying returns profile than the norm. For example, Bays by Danube recorded only ~10% total Capital Appreciation since launch (~1.2% YoY), however the annualised rental yield delivered was nearly ~11.35%.[1]

In summary, Dubai hotel investments deliver higher, steadier returns with far less hassle, and lower investment thresholds, but have lower capital price appreciation, and lower liquidity than residential investments; and therefore, the asset class attracts different investors as compared to residential off-plan investments.

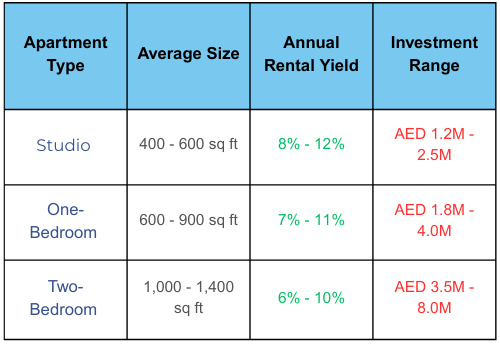

The High-Yield Reality: Understanding Hotel Apartment Returns

The rental yields in Dubai's hotel apartment sector consistently outperform traditional residential and even long-term commercial real estate, and here's why:[2]

Yield Breakdown by Property Type[1]

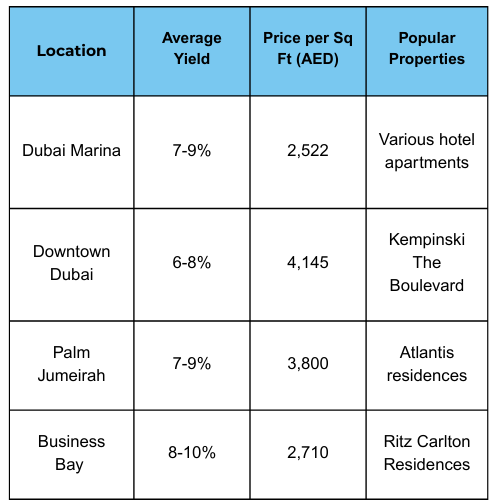

Location-Based Yield Analysis:[1]

Based on market data from the past 12 months:

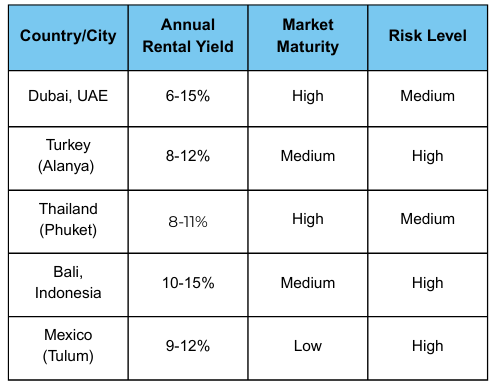

Dubai vs. Global Hotel Investment Markets

To put Dubai's performance in perspective, here's how it compares to other popular hotel investment destinations[6]:

Global Rental Yield Comparison[6]:

Dubai's competitive advantage lies in:

- Political Stability: Established governance and investor protection

- Infrastructure: World-class airports, connectivity, and facilities

- Tourism Diversity: Business, leisure, and transit tourism

- Regulatory Framework: Clear property laws and ownership rights

- Currency Stability: AED pegged to USD provides significant stability

- Tokenisation and Crypto Friendliness - Dubai properties, including hotel properties can be transacted with Cryptos (subject to rules)

Future Projections: The Road Ahead (2025-2030)

The future of Dubai's (and a few other UAE locations) hotel apartment market looks remarkably bright for the medium term.[5]

Supply Pipeline[5]:

- 11,300 new hotel rooms expected by 2027

- Dubai Economic Agenda D33: Aims to make Dubai a top-3 global tourism destination

- Expo Legacy: Continued infrastructure and tourism benefits

Demand Drivers[3]:

- 40 million visitors projected by 2031

- 25% industry growth expected by 2030

- Regional Hub Status: Growing importance as Middle East business center

Investment Climate (2024-2025)[5]:

- Occupancy: Currently at 78.1% (December 2024)

- Average Daily Rate: ~AED 690 (slight increase from 2023)

- RevPAR Growth: 1.3% year-over-year

Why Choose AFINUE for Your International Property led Investments, especially in UAE

We understand that investing in international markets, whether immigration linked property investment or for asset risk diversification, requires more than just property or market knowledge. Such investment decisions demand local expertise built over time, regulatory understanding, monetisation and liquidity support and overall a pulse of the regional and global economy, to not just choose the right investment but also factor in exit options and liquidation preferences right upfront. Here's why discerning investors choose us:

Our Expertise:

- Market Intelligence: Deep understanding of Dubai's real estate market and future potential.

- Verified Properties: Pre-screened investments with transparent yield projections, directly sourced from Developers.

- Legal Compliance: Complete assistance with UAE property regulations and procedures, handholding through the transaction life cycle and beyond.

- Portfolio Diversification: Advice is not limited to project, but actually pin pointed to which units, which floors, and what views/ orientation.

- Post-Purchase Support: Ongoing property intelligence, support in monetisation/ liquidity event selection, with on ground local partnerships

More Than Real Estate: Owning a Share of Dubai’s Tourism Boom

Dubai's (and few other UAE locations) hotel apartment market represents more than just an investment opportunity – it's a chance to participate in one of the world's most dynamic hospitality markets. With rental yields significantly outperforming traditional real estate, high quality constructions and professional management and a city that has proven its resilience and growth trajectory as a global tourism destination, the case for hotel apartment investment has never been stronger.[2]

The numbers speak for themselves; from record-breaking sales like the AED 200 million One Za'abeel penthouse[7], to consistent 6-15% rental yields across the market[2], Dubai continues to attract investors who understand the value of combining high yield real estate investments with hospitality-led developments.

As we move forward through 2025 and beyond, with 11,300 new hotel rooms coming online by 2027 and Dubai's ambition to become a top-3 global tourism destination, the thesis to invest in this sector remains compelling.[5]

Whether you're a seasoned real estate investor looking to diversify your portfolio or a newcomer attracted by the high yields and professional management, Dubai's hotel apartment market offers a unique proposition that deserves serious consideration.

Bibliography:

[1] Bayut Sales Data - Dubai Hotel Properties Research (2025)

[2] The First Group - "Why Dubai is the World's Hottest Hotel Investment Market" (2023) -https://www.thefirstgroup.com/en/news/why-dubai-is-the-world-s-hottest-hotel-investment-market/

[3] MMC Investment - "UAE Hospitality Industry Performance and Outlook 2015-2029" - https://www.mmcginvest.com/post/uae-hospitality-industry-performance-and-outlook-2015-2029

[4] Cavendish Maxwell - "Dubai's Hospitality Sector Market Performance in 2023" - https://cavendishmaxwell.com/insights/reports-and-whitepapers/dubais-hospitality-sector-market-performance-in-2023

[5] KPMG - "Dubai Hospitality Report 2025" - https://assets.kpmg.com/content/dam/kpmg/ae/pdf-2025/04/dubai-hospitality-report.pdf

[6] NevEstate - "Best Resort Real Estate Investments 2025: Top 5 Countries" (5 months ago) - https://nevestate.com/uncategorized-en/best-resort-real-estate-investments-2025-top-5-countries/

[7] Hotel Report - "Record Breaking Sale: Dubai's Most Expensive Hotel Apartment Sells for 200 Million Dirhams" - https://hotel.report/management/record-breaking-sale-dubais-most-expensive-hotel-apartment-sells-for-200-million-dirhams

[8] Excel Properties UAE - Downtown Dubai Property Prices: Trends, Growth and ROI Potential - https://excelproperties.ae/blog/downtown-dubai-property-prices-trends-growth-and-roi-potential

Related Blogs

29-10-2025

Goa’s Real Estate Evolution: From Holiday Haven to Investment Powerhouse

What turned Goa from a tourist spot into India's fastest-growing property market? Read the blog to know how India's coastal paradise transformed into an investment hotspot.

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Holiday homes in India have evolved from family getaways to lucrative investment assets. Discover how shifting preferences, remote work, Airbnb, and fractional ownership are reshaping the holiday home to holiday rental market and how AFINUE is helping investors be a part of it.

01-10-2025

REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

Explore how REITs, InVITs, and real estate tokenization are transforming property investments. Learn how these financial instruments provide liquidity, diversification, and access to high-value real estate for investors, making property investment easier.

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Read How Dubai hotel apartments evolved from pre-COVID growth to post-COVID resilience, now offering investors high yields and global credibility.

02-08-2025

From Free Reign to Regulations

Explore how Dubai’s shift from crypto freedom to regulation is reshaping real estate and how AFINUE mirrors this, with fractional ownership in India.

10-01-2023

Invest in Holiday Rentals

Find out more on the business of 'holiday rentals' - whether to invest in a second home, or use the holiday rental platforms to enjoy a staycation