REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

01-10-2025

Real estate has long been considered as one of the most stable and lucrative investment avenues. However, traditional barriers such as high capital requirements, illiquidity, and complex property management have historically limited access to this asset class to the rich (we are not discussing people buying homes to live in, but real estate as an Investment). Today, innovative financial instruments like Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (InVITs), and cutting-edge real estate tokenization technologies are revolutionizing how investors access both real estate and liquidity. At AFINUE, we believe in making quality real estate investments accessible to all investors, and understanding these evolving mechanisms is crucial for making informed investment decisions.

Understanding REITs:

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate properties. REITs function similarly to listed equity and debt mutual funds, but instead of investing in stocks or bonds, they focus on income-generating real estate assets. REITs are generally structured as TRUSTS, and they allow individual investors to earn dividends from the income generated by the real estate investments, as well as appreciation in the REIT unit, which reflects the underlying properties' price increase, due to macro market changes, liquidity, and/ or capital value changes in land and properties in general. And all these impacts are factored in the value of the investments, without the complexities of directly buying, managing, or financing properties themselves.[1]

REITs invest in diverse property types including apartment buildings, warehouses, data centers, hotels, medical facilities, office buildings, retail centers, and even government buildings (in some countries). What makes REITs particularly attractive is their structure - they are manage in d by real estate professionals who handle property acquisition, management, and maintenance, allowing investors to benefit from professional oversight without landlord responsibilities, while the price discovery is market linked, and yield return is pegged to the rental income from the underlying assets.

To qualify as a REIT and receive favorable tax treatment, companies must legally distribute at least 90% of their taxable income to shareholders annually in the form of dividends (India specific rules). This requirement ensures consistent income streams for investors. Additionally, units of publicly traded REITs are bought and sold on major stock exchanges, providing investors with liquidity and ease of access that traditional real estate investments lack.[1]

The Global Journey of REITs: From US to Worldwide Adoption

Origins in the United States (1960)

REITs began their journey in the United States in 1960, created to enable small investors to earn returns from real estate investments. The concept was revolutionary - it democratized access to large-scale, income-producing real estate that was previously available only to wealthy individuals and institutions.[2]

The growth trajectory has been remarkable. From just 120 REITs globally in 1992, the number exploded to 893 by 2022, reflecting the growing recognition of REITs as an efficient vehicle for real estate investment worldwide.[2]

Global Expansion and Asian Growth

The REIT concept has now been adopted by over 40 countries, with Asia showing particularly impressive growth. Asian REITs increased from 31 in 2005 to 223 in 2022, demonstrating the region's embrace of this investment vehicle.[2]

India's REIT Journey: A Promising Market with Untapped Potential

Late but Promising Start (2019)

India’s markets welcomed its first listed REIT in March 2019 with the listing of Embassy Office Parks REIT, marking a significant milestone in the country's real estate investment landscape. Since then, four additional REITs have joined the market: Mindspace Business Park REIT, Brookfield India Real Estate REIT, Nexus Select Trust REIT and, the most recent entrant, Knowledge Realty Trust (listed in August’ 2025).[2] For readers focused on real estate investment in India, these listings show how institutional real estate can be accessed through listed vehicles.

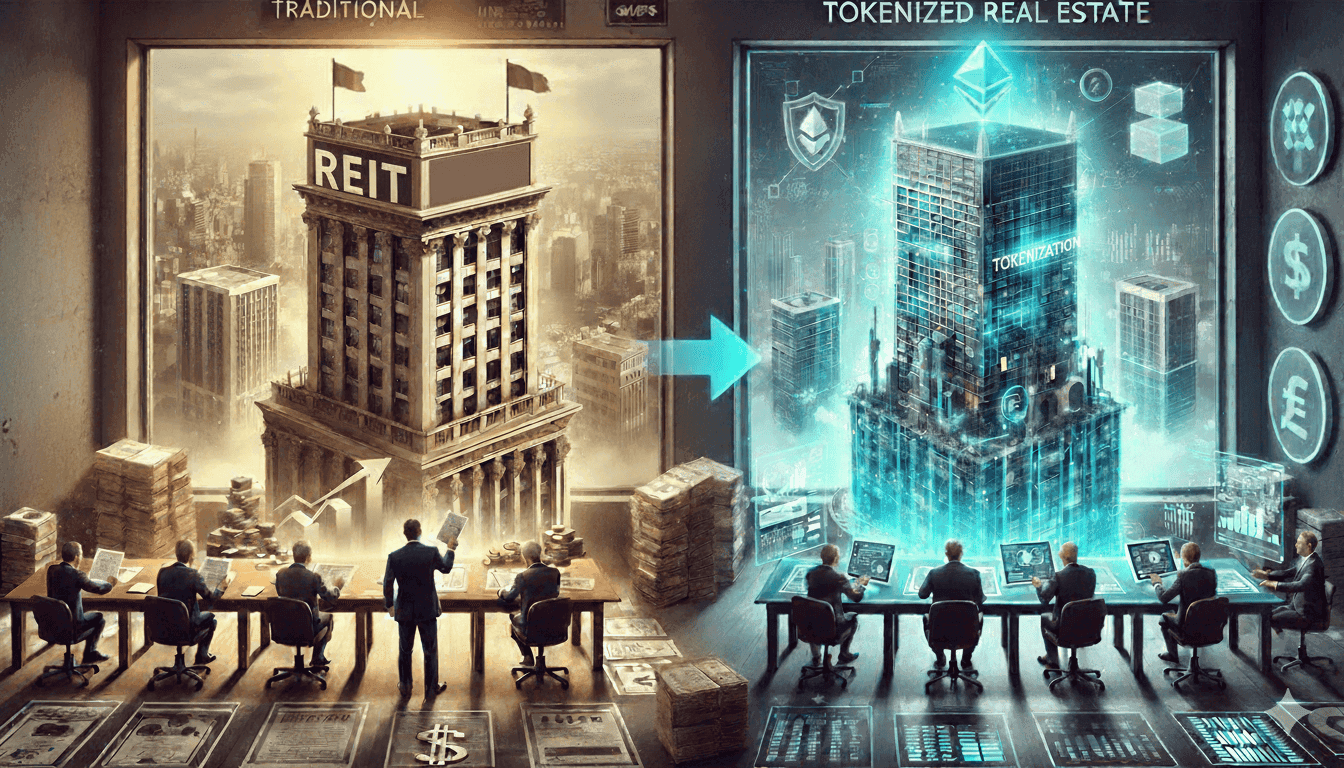

Current Market Status and Growth

The Indian REIT market has achieved a significant milestone, with the combined market capitalization of all four listed REITs surpassing ₹1 lakh crore as of July 2025. This achievement underscores the growing investor confidence and market acceptance of REITs in India.[3]

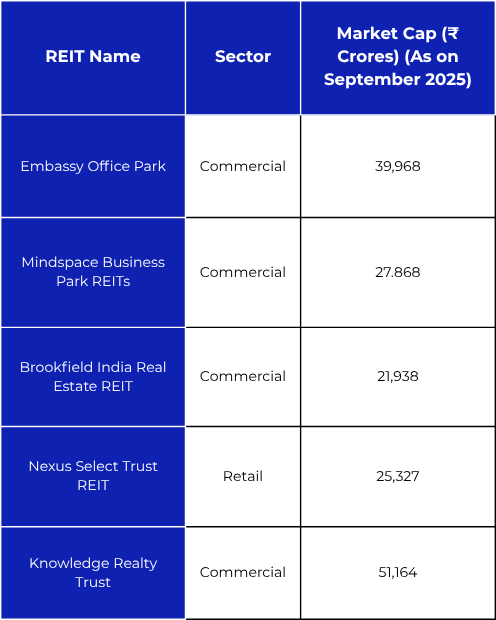

Performance Analysis of Indian REITs

The performance of Indian REITs since their inception has been encouraging for investors: Despite this growth, REITs represent only 13.7% of India's listed real estate market, compared to nearly full penetration in markets like the US and Australia. This indicates significant untapped potential for expansion in the Indian market.

Understanding InVITs: Infrastructure's Answer to REITs

What are InVITs?

Infrastructure Investment Trusts (InVITs) are the infrastructure equivalent of REITs. While REITs focus on real estate assets, InVITs invest in infrastructure projects such as roads, highways, power transmission lines, and renewable energy projects. Like REITs, InVITs follow a similar three-tier structure with sponsors, trustees, and managers.[8]

Revenue Generation and Characteristics

InVITs generate revenue through tolls, tariffs, and user fees collected from infrastructure asset usage, contrasting with REITs' rent and lease-based income model. This fundamental difference affects risk profiles, with InVITs facing regulatory (toll tariff revisions), project execution and maintenance cost increase as well as political risks, whereas REITs deal primarily with market risks affecting vacancy/ occupancy & property value fluctuations, along with interest rate variation risks (affects payouts where properties are leveraged with debt).[8]

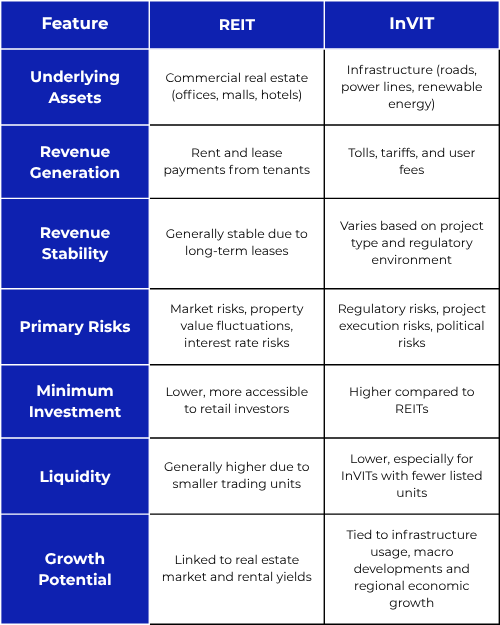

REIT vs InVIT: Understanding the Differences

What then is Tokenization?

Especially in the context of real estate, tokenization is the process of converting physical real estate (real-world assets or RWA) into digital tokens on a blockchain, allowing investors to buy fractional ownership in properties. Instead of needing large capital to purchase entire assets, investors can own small, tradeable portions. This opens access to premium global properties, increases liquidity, and makes real estate investing faster, more transparent, and borderless. Terms often used interchangeably include tokenized real estate, tokenized property, and fractional real estate investment.

The Tokenization Revolution: Digitizing Real Estate Investment

Early Pioneers and Global Adoption

The concept of real world asset tokenization began with experimental projects like Venezuela's Petro in February 2018. Though it failed due to various political and economic factors, it did kindle the tech innovation cycle that enabled future projects.[9] The tokenization of the St. Regis Aspen Resort in 2018, in the US was not only successful, in contrast to what happened in Venezuela, it also became the torchbearer and one of the first high-profile tokenized real estate assets in the world.

The St. Regis Aspen tokenization project was groundbreaking - Aspen Digital used the Ethereum blockchain to issue security tokens representing fractional ownership of the luxury Colorado resort. The tokenization of the property raised US$18 million, allowing accredited investors to purchase tokens representing shares in the property's revenue. This project demonstrated the potential for increased liquidity through secondary market trading of tokens.[10]

Global Tokenization Landscape

Today, real estate tokenization has gained traction across multiple countries, with varying levels of adoption and regulatory frameworks. Nations like Switzerland, Singapore, the United Arab Emirates (UAE), and several others have emerged as leaders in creating favorable environments for tokenized real estate.[11]

Dubai: Leading the Tokenization Revolution

Dubai's Strategic Initiative

Dubai has positioned itself as a global hub for innovation in tokenized real estate through strategic government initiatives. Dubai has created and activated a “Virtual Asset Regulatory Authority” (or VARA), which is empowered to create and enforce policies covering digital assets, including tokenisation of real-world assets, like real estate. [12]

Under the aegis of VARA and with active participation of the ‘Dubai Land Department Authority’, a RWA tokenization platform has officially launched its pilot phase, activating investments through “mint.prypco.com”. This platform enables users to invest in tokens of Dubai-based real estate, and to benefit from rental and terminal value gains linked returns. [12]

Accessibility and Innovation

The Dubai tokenization project offers remarkable accessibility, with investment opportunities starting from just AED 2,000 (approximately $545). Currently available exclusively to UAE ID holders, with all transactions conducted exclusively in UAE Dirhams without cryptocurrency involvement during the initial pilot phase.[12] In the future, the platform is expected to expand globally, and thereupon, the tokens can also perhaps be purchased and transacted using VARA-approved cryptocurrencies. This example of tokenized property shows how tokenized real estate platforms can open markets to a global pool of investors. PRYPCO was also able to use this project and its past track record to corner a substantial, but undisclosed amount, in fundraising , led by General Catalyst, in its Pre-Series A funding round.

Market Projections and Growth Potential

The future prospects for Dubai's tokenized real estate market are exceptionally promising. Experts project that tokenized assets could represent up to 7% of Dubai's real estate market by 2033, equating to approximately AED 60 billion ($16 billion). On a global scale, real estate tokenization is anticipated to reach a market cap of $19.4 billion by 2033, with an annual growth rate of 21%.[12]

Landmark Tokenization Projects in Dubai

Project One: J One Business Bay Apartment

On May 25, 2025, Dubai made history with the launch of the first MENA-region tokenized real estate listing on the Prypco Mint platform. This pioneering project featured a two-bedroom apartment in Business Bay's J One development by Damac, listed at AED 2.4 million - below its DLD valuation of AED 2.89 million.[15] [16]

Key Statistics:

- Total Investment Required: AED 2.4 million

- Time to Full Subscription: 24 hours

- Number of Investors: 224 investors

- Nationalities Represented: 44 countries (though all probably had Emirate ID)

- First-time Dubai Investors: 70% of participants

- Average Investment: AED 10,714

This project's success demonstrated strong investor confidence and highlighted the accessibility provided by flexible, low-cost digital solutions.[16]

Project Two: Kensington Waters, Mohammed Bin Rashid City

Dubai's second tokenized property launch featured a one-bedroom apartment in Kensington Waters, Mohammed Bin Rashid City, with a total valuation of AED 1.5 million. Offered at a discounted rate compared to its estimated market value of AED 1.875 million, this project provided investors with instant equity and value.[17] [18]

Record-Breaking Performance:

- Time to Full Subscription: 1 minute and 58 seconds (world record)

- Number of Investors: 149 investors

- Nationalities Represented: 35 countries

- Waiting List Growth: Over 10,700 investors

Project Three: Rukan Community Villa

The third tokenized property was a villa in Rukan Community, Dubailand, valued at AED 1.75 million. [13] [14]

Performance Metrics:

- Time to Full Subscription: Under 5 minutes

- Average Investment: AED 10,355

- Total Investors: 169

- Nationalities: 40 countries

The Future of Real Estate Investment

Technology-Driven Transformation

The evolution from traditional real estate investment to REITs, and now to real estate tokenization, represents a technology-driven transformation that continues to lower the barriers to entry while increasing transparency and efficiency. Each innovation has made real estate investment more accessible to a broader range of investors.

Convergence of Traditional and Digital

The future likely holds a convergence of traditional real estate investment vehicles like REITs with blockchain-based tokenization technologies. This hybrid approach could combine the regulatory framework and professional management of REITs with the accessibility and liquidity benefits of tokenized real estate and fractional real estate investment.

Regulatory Evolution

As tokenization gains momentum, regulatory frameworks are evolving to accommodate these innovations while protecting investors. Dubai's government-backed initiative serves as a model for how regulatory authorities can facilitate innovation while maintaining market integrity.[12]

Conclusion: Embracing the Future of Real Estate Investment

The journey represents a continuous evolution toward greater accessibility, liquidity, and efficiency. India's growing REIT market, with its ₹1 lakh crore market-cap milestone, demonstrates the appetite for innovative real estate investment vehicles. Meanwhile, Dubai's pioneering tokenization initiatives showcase the potential for technology to further democratize real estate investment and opening up a whole new global investment avenue.

At AFINUE, we recognize that the future of real estate investment lies in embracing these innovations while maintaining the fundamental principles of sound investment analysis and risk management. Whether through REITs, SMREITs (small and medium REITs as approved by India's Market Regulator in 2024), InVITs, or emerging tokenization platforms, the goal remains consistent: providing investors with accessible, transparent, and professionally managed opportunities to participate in real estate markets.

As we look toward the future, the convergence of traditional real estate expertise with cutting-edge technology promises to create even more accessible investment opportunities. For investors, staying informed about these evolving mechanisms is crucial for building diversified and resilient portfolios that can capitalize on the continued growth of global real estate markets.

The evolution continues, and at AFINUE, we're committed to helping investors navigate this dynamic landscape with confidence and success.

Bibliography:

- The Motley Fool. "What is a Real Estate Investment Trust (REIT)?" https://www.fool.com/terms/r/real-estate-investment-trust/

- India Brand Equity Foundation (IBEF) "Evolution of REIT in India: From Inception to Current Trends." https://www.ibef.org/blogs/evolution-of-reit-in-india-from-inception-to-current-trends

- Economic Times. "Indian REITs cross Rs 1 lakh crore market cap, marking a milestone in sector growth." July 30, 2025. https://economictimes.indiatimes.com/markets/digital-real-estate/realty-news/indian-reits-cross-rs-1-lakh-crore-market-cap-marking-a-milestone-in-sector-growth/articleshow/123217348.cms

- Chittorgarh.com. "IPO Performance Tracker - Embassy Office Parks REIT." https://www.chittorgarh.com/ipo/ipo_perf_tracker.asp?name=Embassy%20Office%20Parks%20ReIT%20REIT&id=971

- Chittorgarh.com. "IPO Performance Tracker - Mindspace REIT." https://www.chittorgarh.com/ipo/ipo_perf_tracker.asp?name=Embassy%20Office%20Parks%20ReIT%20REIT,Mindspace%20ReIT%20REIT&id=971,1051

- Chittorgarh.com. "IPO Performance Tracker - Brookfield India REIT." https://www.chittorgarh.com/ipo/ipo_perf_tracker.asp?name=Brookfield%20India%20ReIT%20REIT&id=1082

- Chittorgarh.com. "IPO Performance Tracker - Nexus Select Trust REIT." https://www.chittorgarh.com/ipo/ipo_perf_tracker.asp?name=Nexus%20Select%20Trust%20REIT&id=1417

- HDFC Sky. "Difference Between REIT and InVIT." - https://hdfcsky.com/sky-learn/personal-finance/difference-between-reit-and-invit

- Investopedia. "Petro Cryptocurrency." https://www.investopedia.com/terms/p/petro-cryptocurrency.asp

- RWA Paris. "Case Studies: Successful Implementations of Real World Asset Tokenization." https://www.rwaparis.xyz/blog/case-studies-successful-implementations-of-real-world-asset-tokenization

- BinaryX. "The 8 Best Countries for Crypto and RWA Tokenization: A 2025 Guide for Investors and Entrepreneurs." https://www.binaryx.com/blog/the-8-best-countries-for-crypto-and-rwa-tokenization-a-2025-guide-for-investors-and-entrepreneurs

- Dubai Land Department. "DLD Launches the MENA's First Tokenized Real Estate Project through the Prypco Mint Platform." https://dubailand.gov.ae/en/news-media/dld-launches-the-mena-s-first-tokenized-real-estate-project-through-the-prypco-mint-platform

- Gulf News. "Dubai tokenization platform Prypco Mint sells out another property - this time in under 5 minutes." https://gulfnews.com/business/property/dubai-tokenization-platform-prypco-mint-sells-out-another-property-this-time-in-under-5-minutes-1.500194878

- Times of India. "UAE: What is real estate tokenization? Dubai's Prypco sells out Dh1.75 million tokenized villa in under 5 mins." https://timesofindia.indiatimes.com/world/middle-east/uae-what-is-real-estate-tokenization-dubais-prypco-sells-out-dh1-75-million-tokenized-villa-in-under-5-mins/articleshow/122419572.cms

- Khaleej Times. "Dubai developers list tokenised properties on Prypco Mint." https://www.khaleejtimes.com/business/property/dubai-developers-list-tokenised-properties-prypco-mint

- Economy Middle East. "Dubai Land Department launches world's first property token ownership certificate." https://economymiddleeast.com/news/dubai-land-department-launches-worlds-first-property-token-ownership-certificate/

- Economy Middle East. "Dubai's second tokenized property sells out in record-breaking one minute and 58 seconds." https://economymiddleeast.com/news/dubais-second-tokenized-property-sells-out-in-record-breaking-one-minute-and-58-seconds/

- Economy Middle East. "Dubai's second tokenized property launched as city expands blockchain real estate." https://economymiddleeast.com/news/dubais-second-tokenized-property-launched-as-city-expands-blockchain-real-estate/

Related Blogs

29-10-2025

Goa’s Real Estate Evolution: From Holiday Haven to Investment Powerhouse

What turned Goa from a tourist spot into India's fastest-growing property market? Read the blog to know how India's coastal paradise transformed into an investment hotspot.

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Holiday homes in India have evolved from family getaways to lucrative investment assets. Discover how shifting preferences, remote work, Airbnb, and fractional ownership are reshaping the holiday home to holiday rental market and how AFINUE is helping investors be a part of it.

01-10-2025

REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

Explore how REITs, InVITs, and real estate tokenization are transforming property investments. Learn how these financial instruments provide liquidity, diversification, and access to high-value real estate for investors, making property investment easier.

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Read How Dubai hotel apartments evolved from pre-COVID growth to post-COVID resilience, now offering investors high yields and global credibility.

02-08-2025

From Free Reign to Regulations

Explore how Dubai’s shift from crypto freedom to regulation is reshaping real estate and how AFINUE mirrors this, with fractional ownership in India.

10-01-2023

Invest in Holiday Rentals

Find out more on the business of 'holiday rentals' - whether to invest in a second home, or use the holiday rental platforms to enjoy a staycation