From Retreat to Returns: The Rise of Holiday Rentals in India

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Just a decade ago, owning a holiday home in India was more of an emotional decision than a financial one. It was about creating memories with family, weekend escapes, and a slower lifestyle away from the rush of urban living. It was also a wealth flex, as holiday homes were the prerogative of the wealthy. Buyers looked for second homes close to their primary cities like Lonavala or Alibag for Mumbaikars and Nainital or Kasauli for Delhiites, so they could drive down for a quick break or the long weekends.

But that was then. The game has changed since the advent of purpose-built holiday homes, and holiday home management services, over the last 10-15 years.

Today, the Indian second home is no longer just a quiet retreat. It’s a diversified asset. It earns. It appreciates in value and provides yield, it offers serenity when needed and returns when rented. And it’s attracting a new generation of investors, thanks to evolving mindsets, digital platforms and innovative ownership models.

When Holiday Homes Were Just for Holidays

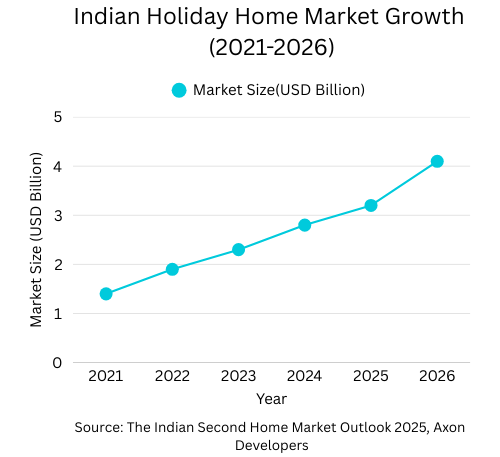

Before COVID-19 disrupted our lives, the Indian holiday home market was a different beast altogether. Back in 2021, the entire sector was valued at merely USD 1.39 billion.[1] Holiday homes were primarily viewed through a single lens: family relaxation and bonding, and given to Bed & breakfast operators, who would use these for short term rentals on Air BnB or home grown platforms, and listing sites.

The mindset was uncomplicated. Mass affluent families would pool their savings, often across generations, to purchase a modest villa where they could escape during festivals, school holidays, and long weekends. The return on investment? Priceless family memories and the occasional pride of hosting relatives for a meetup. Post Global financial crises, a large demand for such properties arose across the board, in Lonavala near Mumbai, Nandi Hills near Bangalore, and whole host of places in the North, from Kasauli, Solan, Chail (aided by Air travel enablement to Shimla), to Nainital and Mukteshwar on the Kumaon Hills. The demand for such places went off the charts in Goa, where people from across the country wanted a Holiday villa, given nearly 12 months of sunshine, direct air connectivity from most places, and international connectivity too.

The traditional post mid-20th-century crowd pullers on the Garhwal hills, Mussoorie and Rishikesh were also getting attractive as holiday home locations due to direct air connectivity with Dehradun.

Back then, if someone asked about rental yields or appreciation rates, most holiday home owners would give you a blank stare. The primary currency was happiness, pride of ownership, not yield.

The Airbnb Revolution: When Homes Became Businesses

When we talk about the evolution of holiday homes, it’s impossible to ignore the global disruptor - Airbnb. Launched in 2008 in the US, Airbnb transformed how travelers viewed short-term stays. Instead of relying solely on hotels, guests could now book private homes, apartments, or unique stays + experiences, all hosted by individuals or families. By digitalizing and democratizing the homestay model, Airbnb empowered millions of homeowners in the US and later across the world, to monetize their unused or underutilised properties, while giving travelers access to more affordable, authentic, and localized experiences. This massive shift not only challenged traditional hotels but also forced global hospitality giants like Hyatt and Marriott to embed “homes and villas” into their growth strategies.

Hyatt responded by investing in home-rental platforms like OneFineStay, while Marriott created its dedicated Homes & Villas by Marriott Bonvoy program in 2019, offering premium curated properties with hotel-grade consistency. Recognizing the growing appetite for private holiday homes, these groups quickly expanded the concept to emerging markets, including India. By 2022, Marriott’s Homes & Villas program made its debut in India, with luxury vacation rentals in destinations like Goa and Lonavala, blending the familiarity of a global brand with the intimacy of private villa stays.

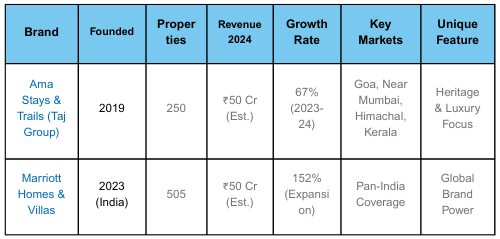

In India, the shift was also accelerated by domestic hospitality leaders. The Taj Group was among the first movers, launching Amã Stays & Trails in 2019, a curated collection of heritage bungalows, luxury homestays, and private villas across the country. These properties combined the charm of traditional homes with Taj’s legendary service standards, setting a new benchmark in experiential travel. Together, these global and Indian hospitality giants professionalized what was once an unorganized, host-driven sector.

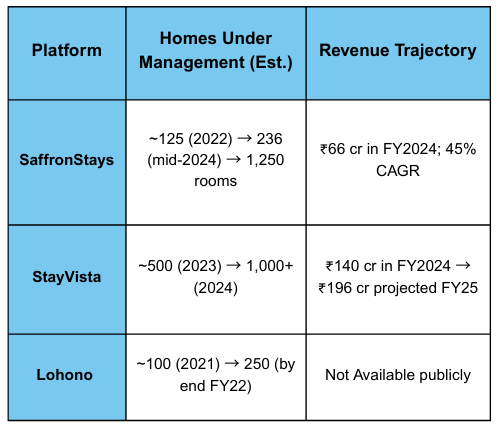

Meanwhile, inspired by Airbnb’s success, India saw the rise of its own vacation rental platforms between 2013 and 2016. StayVista (founded in 2015 as Vista Rooms), SaffronStays (2014), and Lohono Stays by Isprava became the country’s homegrown avatars of the holiday home revolution.[5] Each brought something unique, StayVista with its tech-enabled villa network, SaffronStays with its focus on heritage and experiential homes, and Lohono with its ultra-luxury positioning backed by Isprava’s design-led approach.

The entry of global brands like Marriott and Hyatt, domestic leadership of Taj, and the entrepreneurial push from startups like StayVista, SaffronStays, and Lohono, together, transformed India’s holiday home landscape forever. What began as an informal, host-managed model has now matured into a structured asset class backed by technology, institutionalised hospitality grade services, and real estate credibility making holiday homes a serious investment opportunity and not just a lifestyle choice.

The Great Awakening: How a Pandemic Changed Everything

Then came 2020, and with it, a fundamental shift in how Indians perceived life, work, and wellness. The pandemic didn't just change where and how we worked (work from anywhere), it also ignited a strong desire to live free and far from cities, traffic and pollution.

Suddenly, the cramped Mumbai apartments or the polluted Delhi air felt suffocating. The Hills, Beachside and Mountains weren't just calling for a weekend getaway; they were beckoning for a permanent lifestyle change. As remote work became mainstream, the traditional constraints of location dissolved.

According to some developers’ and their commissioned research, like that of 360 Realtors/Axon Developers, “Indian Second Home Market Outlook 2025”, the Indian second home market has experienced explosive growth, from USD 1.39 billion in 2021 to USD 3.2 billion in 2025, a staggering 130% increase in just four years. This market is projected to reach USD 4.1 billion by 2026, indicating the momentum is far from slowing down.[1]

Wellness and work-life balance became mainstream post-pandemic and played a crucial role in this market transformation. People wanted frequent ‘staycations’ and families started opting for more frequent, but shorter holidays, rather than waiting for one big annual sojourn. Suddenly, having a retreat in the hills or at the beachside wasn't just a luxury, it was a need; and you did not have to own an expensive Villa or Bungalow of your own, you could just rent and live.

The Trickle Down Effect of post Covid revenge travel and Airbnb on Indian Holiday Rental Market

India’s holiday rental landscape has witnessed explosive growth post-pandemic, led by domestic platforms that have rapidly scaled both inventory and revenues in just a few years.[3][5]

For the owners and recent investors, thanks to these platforms, suddenly, that weekend villa in Kasauli or Goa wasn't just a family retreat, it was a potential revenue generator.[5]

Smart homeowners began calculating occupancy rates, seasonal pricing, and yield percentages. Research suggests that well-managed second homes can generate 7-9% rental returns, making them attractive investment propositions beyond their lifestyle benefits.[2]

The emergence of tech-enabled holiday rental businesses, replete with their digital demand generating platforms, have professionalized the entire ecosystem. What was once a casual "rent out to friends" or run your own AirBnB as Host arrangement, became sophisticated hospitality businesses with standardized services, professional guest management, embedded culinary experience and dynamic pricing strategies. The post-COVID era marked a dramatic shift in the way people approached travel, leisure, and real estate investments. With growing desire for short distance getaways, the hospitality industry in India saw a major boom particularly in the holiday rental segment.[3] This rising demand for short-term, luxury stays in well connected locations didn’t go unnoticed by operators or developers.

Owning, Not Just Using

The idea of holiday home investments has evolved dramatically over the past few decades. Back in the 1980s, the United States popularized the condominium timeshare model, where multiple families could “buy time” in a resort property, usually a week or two every year. It democratized vacation ownership but came with a catch: buyers only secured the right to use the property for a set period, without any claim to capital appreciation in the underlying real estate.

India adopted a similar approach in the 1990s and 2000s through brands like Club Mahindra and Sterling Holidays, which offered vacation memberships. Families could enjoy holiday stays at resorts across the country (and even at international locations), but these were essentially prepaid holidays not real estate investments. Members enjoyed usage rights, yet there was no direct participation in property value growth.

The next evolution, turbo charged by the post Covid market boom, came with fractional ownership. Here, investors collectively bought actual shares in a luxury holiday home or a cluster of villas, splitting not just the usage but also the potential capital appreciation and rental income. Unlike timeshares, this model turned leisure assets into genuine investments.

Globally, one of the most successful adaptations of this concept was seen in Dubai, which refined fractional ownership to allow investors both personal usage days and steady rental returns from Hotel property investments. While Dubai was not the first to introduce fractional hospitality property ownership, its real estate-friendly regulatory framework and booming tourism industry made it a benchmark for structured hospitality backed real estate investments.

In India, although the Dubai-style fractional ownership model has not yet been fully institutionalized for Hotels, the entry of platforms like Airbnb, along with hotel chains such as Taj’s Amã Stays & Trails, Marriott’s Homes & Villas, and Hyatt Residences, has significantly professionalized the segment, allowing for more direct ownership of purpose built holiday rental properties.

The improved occupancies delivered more predictable returns, and transformed holiday homes from being a lifestyle indulgence into a serious investment category for Indian buyers, which led new age developers, including those with rental operating arms (eg. Vianaar and Isprava) to position their real estate project more as long term yield products.

Isprava has redefined second-home living with curated villa developments in Goa, Alibaug, and Coonoor, blending aesthetics, service, and exclusivity. Vianaar has been also building and managing high-end holiday homes tailored for both end users and investors for over a decade, primarily in Goa, and now expanding in other locations in India. Developers like HOABL have gone one step further, and introduce plotted land developments (as against developed villas), in large township layouts, focused on this investment segment.

The emergence and sustainable growth of these players over time gave investors the confidence, transforming holiday homes into investment vehicles, and rentals into high yield returns, rather than just being an offset for maintenance costs.

Market Size Growth Trajectory (2021-2026)[1]

Source: The Indian Second Home Market Outlook 2025, Axon Developers

The Accessibility Challenge: When Dreams Meet Price Reality

As holiday homes evolved into an aspirational asset class, affordability became the biggest hurdle. What was once a second-home dream for mass affluent families has now escalated into the territory of High Net-Worth Individuals (HNIs) and Ultra-HNIs.[2]

The traditional nuclear family found itself priced out of many desirable destinations. North Goa, once accessible to middle-class families, now sees basic yield generating villa prices starting at INR ~3 crores (properties that can generate 7%+ yields).

Developers like Isprava and Vianaar have transformed the market, especially in North Goa and Kasauli, with their premium positioning and curated communities. Their homes are exquisite but they come with price tags that place them far beyond the reach of the typical nuclear family or even the upper-mass-affluent segment.

- Isprava (Goa & Hills): Recent reports place Isprava villas between ₹7 crore and ₹45 crore, depending on location and size, with earlier coverage citing a broader ₹4–50 crore range.[4] Prime Goa markets such as Assagao, Anjuna, Vagator, and Siolim now trade firmly in the ultra-luxury bracket.

To put this into perspective, a prime villa in Goa now easily costs ₹5–10 crore, with the ultra-premium stock surpassing ₹20–50 crore. Even a relatively modest branded holiday villa in Goa or Kasauli now commands ₹3.5–5 crore. Even “upper-mass-affluent” buyers (net worth in the low single-digit crores) find themselves priced out of whole ownership in these destinations. The only families able to buy outright are HNIs, and often even they treat such purchases as one-off lifestyle indulgences rather than diversified investments.

This is where fractional ownership emerges as the practical solution. Rather than committing ₹5–15 crore to a single asset fractional structures allow investors to:

- Part ownership in ultra-premium homes at a fraction of the cost;

- Transfer operational and maintenance responsibilities managed by established operator;

- Participate in rental yield opportunities like any other asset backed debt investment products;

- Diversify exposure instead of locking capital into a single property or location.

Similarly, premium locations in Himachal Pradesh and Uttarakhand have witnessed 20-25% annual appreciation in prices, making them increasingly unaffordable for individual buyers.[2]

This price surge created a new class divide in the holiday home market. While the ultra-wealthy expanded their portfolios, the aspirational middle class watched from the sidelines, unable to participate in what was clearly a lucrative and lifestyle-enhancing asset class.

Challenges and Opportunities

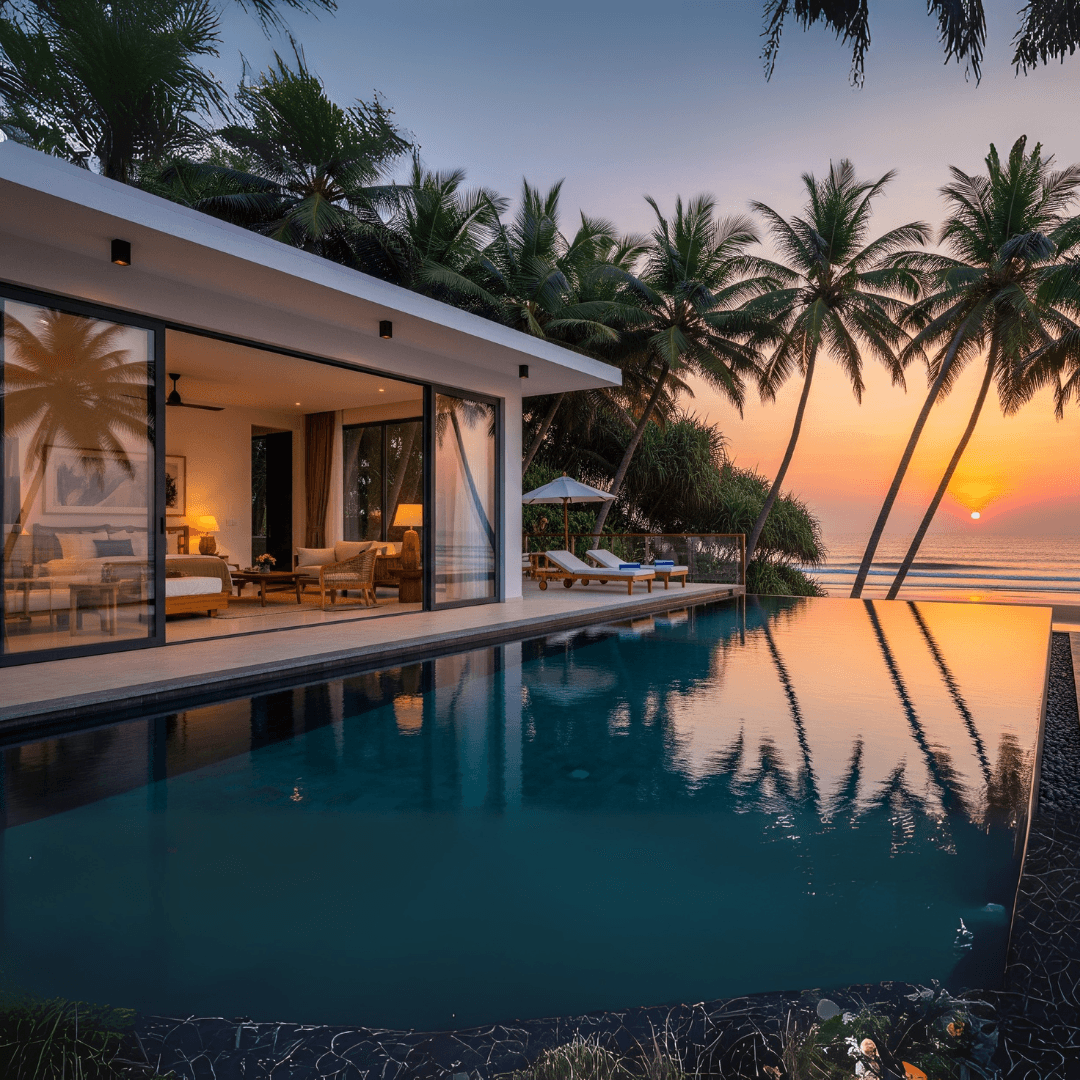

For many, the idea of owning a private holiday home in Goa, Kasauli, or Alibaug feels like the ultimate lifestyle upgrade. A villa with sweeping views, a poolside barbecue, and the freedom to escape city chaos at will. But once you move past the dream, the reality of owning and managing such a property is far more complex.

Regulatory complexities, land acquisition issues, and seasonal demand fluctuations continue to pose hurdles to the yield stabilisation and growth. Many Himalayan and northeastern destinations still suffer from overall poor infrastructure and its impact on accessibility.[2]

The Hidden Challenges

1. Land acquisition hurdles

Holiday home hotspots like Goa, Himachal, and Uttarakhand often come with domicile restrictions. For non-local buyers, this means navigating a maze of legal structures, approvals, and extra costs. What looks like a quick purchase often stretches into months of paperwork.

2. Airbnb isn’t just plug-and-play

The rise of Airbnb and short-term rental platforms has inspired many owners to think of their villa as a revenue generator. But operating an Airbnb in India requires licenses, tourism department approvals, neighborhood (residents society) / panchayat approvals, which in turn require health and safety certifications. All these are then compounded with local manpower vs migrant labour issues. Processes vary widely by state as well as local authorities and, without professional management, many owners find themselves stuck between bureaucracy and underutilization.

3. The high cost of stand-alone ownership

Running a luxury villa isn’t just about paying the mortgage or offsetting the maintenance costs. Staff salaries, pool upkeep, horticulture and security easily add up to significant spends, even without extensive utilisation. For individual owners, these costs feel disproportionate to actual usage. Developers like Vianaar and Isprava counter this by creating clusters of villas, where shared services bring down per-unit operating costs and ensure hotel-grade upkeep, something a single villa can rarely match.

4. Operational stumble blocks

From hiring trustworthy caretakers, who stay put for long term, to ensuring smooth guest experience, owning a holiday home can feel less like leisure and more like running a small hotel. Without economies of scale, every minor issue; plumbing, electrical and power backup, air conditioning, staff attrition, local infrastructural issues, all lands squarely on the owner’s plate.

The Opportunity in Disguise

And yet, the appeal of holiday homes and holiday rentals keeps growing; why? Because the fundamentals are compelling. Tourism is booming. India’s leisure travel segment is expanding in double digits, with a strong preference for private villa stays over traditional hotels.[3]

Rental yields are attractive. Professionally managed, well located and uniquely done up villas in destinations like Goa, or near large metros like Mumbai and Bengaluru or the Hills, up in the north, often deliver 8–12% annual rental yield, even while working only a few months in the year.[2] Capital appreciation is real. Scarce land in high-demand micro-markets like Assagao, Siolim, or Anjuna in Goa, and cantonment-adjacent areas of Kasauli, has driven consistent long-term price growth.[2]

For investors, this combination of income + appreciation makes holiday homes more than just a lifestyle indulgence, it’s a serious asset class, only if they can afford the high cost of purchase that has set in. Developers like Isprava and Vianaar are pricing their villas between ₹5 crore and ₹45 crore (estimates for new launches), firmly in HNI and UHNI territory.[4] Even for affluent families, locking ₹10 crore into a holiday home feels inefficient. This is where fractional ownership becomes the true game-changer.

The Fractional Revolution: Democratizing Holiday Home Ownership and Investments

Fractional ownership is an age-old concept that's revolutionizing how Indians think about holiday homes as an investment class. Instead of purchasing an entire property, investors can now buy shares or fractions of premium vacation homes, making luxury accessible to a broader demographic. Instead of stretching finances or missing out entirely, investors can:

- Enter at a fraction of the cost. With ₹10–50 lakh, buyers access the same luxury assets that usually demand ₹10 crore;

- Benefit from professional management

- Diversify portfolios. Instead of owning one villa outright, investors can spread across multiple locations, reducing risk while expanding investment options, which they can also use, at a discounted rate (some projects or transactions allow for 7-14 days a year free or at a discounted rate, with black out days).

Fractional ownership, in essence, builds on the dream of a private villa and makes it financially smart, operationally effortless, and accessible beyond the ultra-wealthy. It’s how the holiday home finally transforms from a lifestyle splurge into a scalable investment strategy.

AFINUE: Empowering Investors with Fractional Ownership Opportunities across Holiday Rentals and Hospitality Assets

At AFINUE, we are focussing on clusters of purpose built holiday homes, in areas with good infrastructure and established norms and predictable regulations with established history of operations, reasonable cost of maintenance, and adequate supply of quality manpower.

By leveraging technology, strong local legal legal and regulatory networks, and tie ups with hospitality expertise, we are making premium holiday homes accessible to smaller investors while ensuring professional management and transparent returns.

AFINUE's approach addresses the key pain points of holiday rental investments:

- Curated Portfolio: Hand-picked properties in prime locations

- Legal Clarity: Proper documentation and ownership structures pre-agreed

- Technology Integration: Ensure operators provided key tech integration to allow for adequate asset monitoring; and

- Exit Options: Structured mechanisms for monetising individual ownership interests

While our investors are free to choose holiday destinations, their investments across holiday rental assets generate steady yields, building wealth through appreciation and yield expansion.

Conclusion: The New Age of Holiday Home Ownership

The evolution of India's holiday home market mirrors the broader transformation of the Indian middle class. From simple weekend retreats to sophisticated investment vehicles, holiday homes have become symbols of aspiration, wellness, and financial prudence.[1][2]

Fractional ownership platforms, including AFINUE, are democratizing this space, making it possible for more Indians (resident and non-resident)to participate in this wealth-creating asset class in the steadily growing holiday home rental market.[3]

Bibliography:

[1] Primary Source: The Indian Second Home Market Outlook 2025 - Axon Developers & 360 Realtors. https://www.axondevelopers.com/uploads/1743854899_The%20Indian%20Second%20Home%20Market%20Outlook%202025.pdf

[2] India Retirement and Second Home Market Report 2023 - 360 Realtors- https://static.360realtors.com/Research/PDF/74/RSH%20Market%20Report%20in%20India.pdf

[3] India Vacation Rental Market Report 2025 - Market Research Future- https://www.marketresearchfuture.com/reports/india-vacation-rental-market-21402

[5] Press Reports & Industry Insights – including data on the growth of StayVista, SaffronStays, and Lohono revenue (2022–2024) from Economic Times, Business Standard, and Hospitality Biz News India.

Related Blogs

29-10-2025

Goa’s Real Estate Evolution: From Holiday Haven to Investment Powerhouse

What turned Goa from a tourist spot into India's fastest-growing property market? Read the blog to know how India's coastal paradise transformed into an investment hotspot.

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Holiday homes in India have evolved from family getaways to lucrative investment assets. Discover how shifting preferences, remote work, Airbnb, and fractional ownership are reshaping the holiday home to holiday rental market and how AFINUE is helping investors be a part of it.

01-10-2025

REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

Explore how REITs, InVITs, and real estate tokenization are transforming property investments. Learn how these financial instruments provide liquidity, diversification, and access to high-value real estate for investors, making property investment easier.

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Read How Dubai hotel apartments evolved from pre-COVID growth to post-COVID resilience, now offering investors high yields and global credibility.

02-08-2025

From Free Reign to Regulations

Explore how Dubai’s shift from crypto freedom to regulation is reshaping real estate and how AFINUE mirrors this, with fractional ownership in India.

10-01-2023

Invest in Holiday Rentals

Find out more on the business of 'holiday rentals' - whether to invest in a second home, or use the holiday rental platforms to enjoy a staycation